Are you interested in crypto trading bot building? Then you are at the right place. In the article, we’ll overview everything you should know. Rather than disappearing, cryptocurrency is being adopted as an alternative to the common currency. The features provided by blockchain make cryptocurrencies safe. This, coupled with their mutability, has resulted in people trading crypto day-to-day.

So, let’s go deeper, and start with discussing what crypto trading bots are and the principle they work.

Table of Contents

- 1 What is a Crypto Trading Bot and How Does It Work?

- 2 Key Benefits of Using a Crypto Trading Bots

- 3 The Types of Cryptocurrency Trading Bots

- 4 The Functionality of a Cryptocurrency Trading Bot

- 5 The List of The Most Popular Cryptocurrency Trading Bots

- 6 How to Build a Crypto Trading Bot From Scratch

- 7 Technologies Required to Develop Your Own Crypto Bot

- 8 Final Thoughts

What is a Crypto Trading Bot and How Does It Work?

Cryptocurrency bots are needed to distinguish trends in the market and perform transactions. They take on the monotonous press of the buy and sell button physically and trades on behalf of the trader. Commonly, traders set up a bot with a kit of custom pre-programmed rules that use market markers and tendencies to fulfill the trader’s desires. You can get a trading bot for free through an open-source platform, obtain a licensed one for a fee, or, with sufficient technical background, build one. In contrast to stock trading bots, crypto bots are more affordable and can be used by both newcomers and professionals.

The way the bot works is quite simple. Investors look for cryptocurrency trading bots that will be most beneficial to them and then download the code from the developer. Many bots charge user fees, some of which can be quite high. Each bot has different hardware and software requirements. To maximize the impact of a bot, an investor needs to know how to best use this tool.

In many cases, investors still have to make investment decisions, such as when to buy or sell. A crypto bot is generally not a get-rich-quick solution for an investor unwilling to put in the time and effort needed to be prosperous.

Key Benefits of Using a Crypto Trading Bots

In this part of the article, we’ll overview the most prominent pros of using bots for trading to help you decide whether to invest in them for your own business.

✅ Solid

There is a certain limit to the amount of data a trader can process at a time. Even if all the data is processed, it is hard to find an understanding based on this data.

✅ Performance

Trading cryptocurrency assets using a cryptocurrency bot is always considered to be more performative. There is no sense to worry about delays and human error. As long as the bot receives the proper data and works on suitable algorithms, it can trade assets with the best chances of profit. An added benefit is that these bots can run 24/7.

✅ Emotionless

Bots make every decision based on what it implies. Unlike humans, he is not afraid of loss or is not hungry for profit. Good traders can make rational decisions by suppressing their emotions, but this is not always the case with everyone, especially newcomers.

✅ Preset goals

More than half of investors are said to lose profits because of a combination of factors, most of which involve emotion-based decisions. Crypto bots can help you set goals, thereby eliminating human interaction.

✅ Faster than people

The cryptocurrency market is unstable. A cryptocurrency can rise 25% in a matter of minutes and crash in a minute. Users might miss out on this profit if they do it manually, as it takes a while. This is where trading crypto trading bots help the most. Once you start using bots to make an income, you rarely miss out on profits.

✅ Testing on historical data

If you are using bots, you can do paper trading and backtesting, and use historical data to test if a model or pricing strategy is profitable. It doesn’t matter if you are a veteran or a newbie, everyone has a lot to benefit from these machines. When combined with backtesting, forecasting can help traders understand if the approach they want to take will generate significant profits.

✅ Restriction by pre-established trading rules

Panic is one more reason why people lose money. I.e., if the cryptocurrency you’re investing in crashes, you might panic and sell it without a second thought. Bots are immune to these faults.

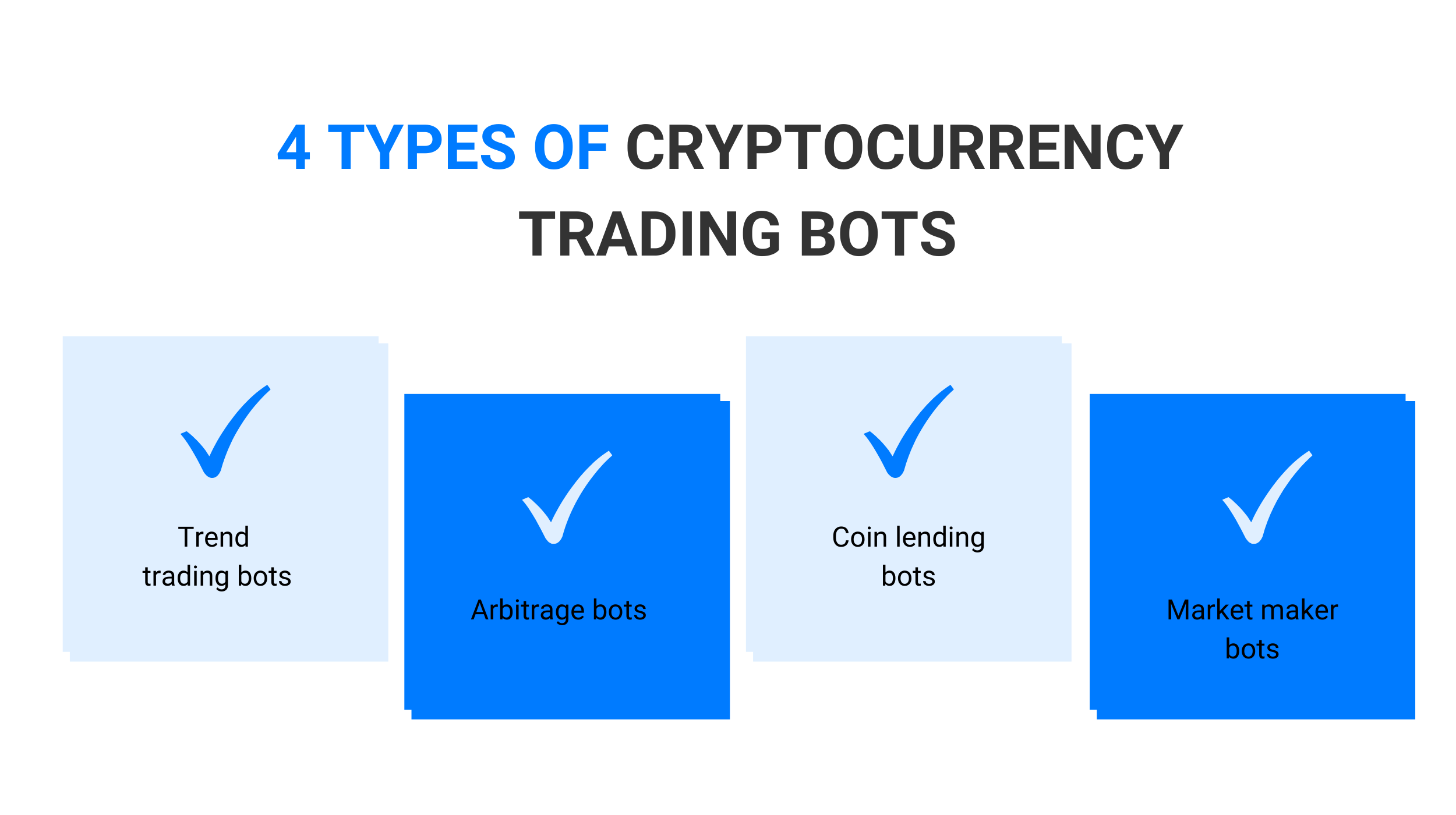

The Types of Cryptocurrency Trading Bots

Not all crypto bots are the same. Here are the most popular types of them.

- Trend trading bots

As the name of the bot suggests, it takes into account the momentum of a specific asset and, after analyzing it, executes buy or sell orders. If the trend shows a price increase, the bot will open a long position. Likewise, he will go short as soon as the price falls. Simply put, trading with a trend implies that the asset will continue to move in the same direction as it is currently, and trend trading bots make this work to their benefit. - Arbitrage bots

This particular bot uses the concept of arbitrage. Arbitrage is a transaction that exploits price imbalances in various markets or various forms. This is especially true in inefficient cryptocurrency markets. By buying and selling an asset at the same time, you can profit from the existing imbalance. Thus, arbitrage crypto bots are programmed to track the distinction between the price of a coin in various markets. To later buy a coin where the price is lower and sell where it is higher. - Coin lending bots

One of the fun ways to make money on cryptocurrencies is to lend coins to margin traders who will later pay you back the loan with interest. Some exchanges like Bitfinex and Poloniex have this margin financing option. However, setting the number of parameters manually every time the margin trader pays back your money is tedious and you need to arrange a new loan. Coin lending bots help automate the process, spend less time finding the right interest rate, and exploit potential spikes in lending options. - Market maker bots

The more actively the asset is traded, the wider the spread will be and the more profit the market maker bots can get. The key principle is to sell to investors at a higher price than the selling price and do it as often as possible. The market maker bot places an order with a price other than the market price and thus making the market makes money for the software owner. It scans markets with wider spreads and does so 24/7, giving the trader an edge in time, volume and price.

The Functionality of a Cryptocurrency Trading Bot

If you want to get the bot with the best performance, make sure the software does a lot of basic and advanced functions. The list of must-have features of any cryptocurrency trading bot includes the following:

⚙ Notifications

The focus of this feature is on user-friendliness, which can be implemented in a variety of ways depending on user preference and individual circumstances. Traders can receive notifications to their email addresses, through popular messaging apps, or via SMS. Thus, they can be informed when the bot completes a successful transaction or when the price of the monitored currency reaches a threshold value preset by the user.

⚙ Implementation and dynamic change of strategy

The core of a cryptocurrency trading bot is the ability to execute a specific strategy, which should be flexible and change depending on the sufficiency of the algorithm.

⚙ Market tracking and history keeping

These two related functions allow you to collect market data and save it for later retrieval, reference, and analysis. This information is important for developing new algorithms and improving old ones. In addition, this feature includes the presentation of reports with data in the form of charts or graphs.

⚙ Backtesting

This is a must if you want to test a new strategy by simulating its outcome using past data from tracking the markets. Backtesting usually takes into account market fees, latency, and other aspects that have a direct impact on transactions.

⚙ Registration, archiving, and retrieval of transaction data

This function keeps a history of all transactions carried out by the trading bot. This way, clients can track their past financial performance and remember when a particular transaction was made.

⚙ Scheduler

This simple functionality allows the bot to work autonomously and only for pre-set periods defined by the user. If necessary, the bot can wake up the device to start and put it into sleep mode or turn off the power after a set period.

⚙ Security

Security is another highly requested feature as account and transaction security concerns every online trader, regardless of the market. Since a trading bot has access to your cryptocurrency wallets, some security measures are necessary, such as strong ones (like biometric authentication).

In addition, a cryptocurrency trading bot must support several of the most popular currencies and exchanges. Of course, there are common currency/exchange bots and you can develop them for yourself, but such a severe limitation is not always a smart choice. At the same time, it should be noted that bots focused only on bitcoins cost less and take less time to develop, which can be defined for many entrepreneurs.

The List of The Most Popular Cryptocurrency Trading Bots

It will be helpful if you research a few suitable applications and get some ideas. You can collect a few important ideas before starting a software development project. Explore the following applications:

🔹 Trality

Trality’s in-browser coding features include smart autocomplete and backtesting. While this new platform adds features, its simple Python integration and particular documentation make sophisticated bot building clear.

🔹 Cryptohopper

Cryptohopper has tremendous power: it operates over 100 tokens on 13 exchanges. It has a variety of packages from $0 to $99 per month. Thus, everyone will find a suitable option. Moreover, Cryptohopper has an extensive toolbox and convenient interface.

🔹 TokenSets

TokenSets is a solid DeFi portfolio management infrastructure with no trading fees set. While some kits are managed by individual or institutional developers, others are “robotic kits” that are automatically rebalanced based on certain technical indicators. TokenSets are a great option for investors interested in getting started with DeFi.

🔹 CryptoHero

With a very affordable price and a plain user interface, CryptoHero is awesome for beginners. It’s also optimized for AI, another benefit for the (gullible) time-limited or newbies.

🔹 Superalgos

Superalgos opens up access to trading crypto bots for newcomers. Its opportunities are amazingly solid and include automated trading, visual strategy design, and back and forward testing.

🔹 Ichibot

Ichibot is a platform for developing trading strategies for those who select code. Customers can develop sophisticated trading strategies for Binance and FTX and perform them in real-time to take benefit of market fluctuations.

How to Build a Crypto Trading Bot From Scratch

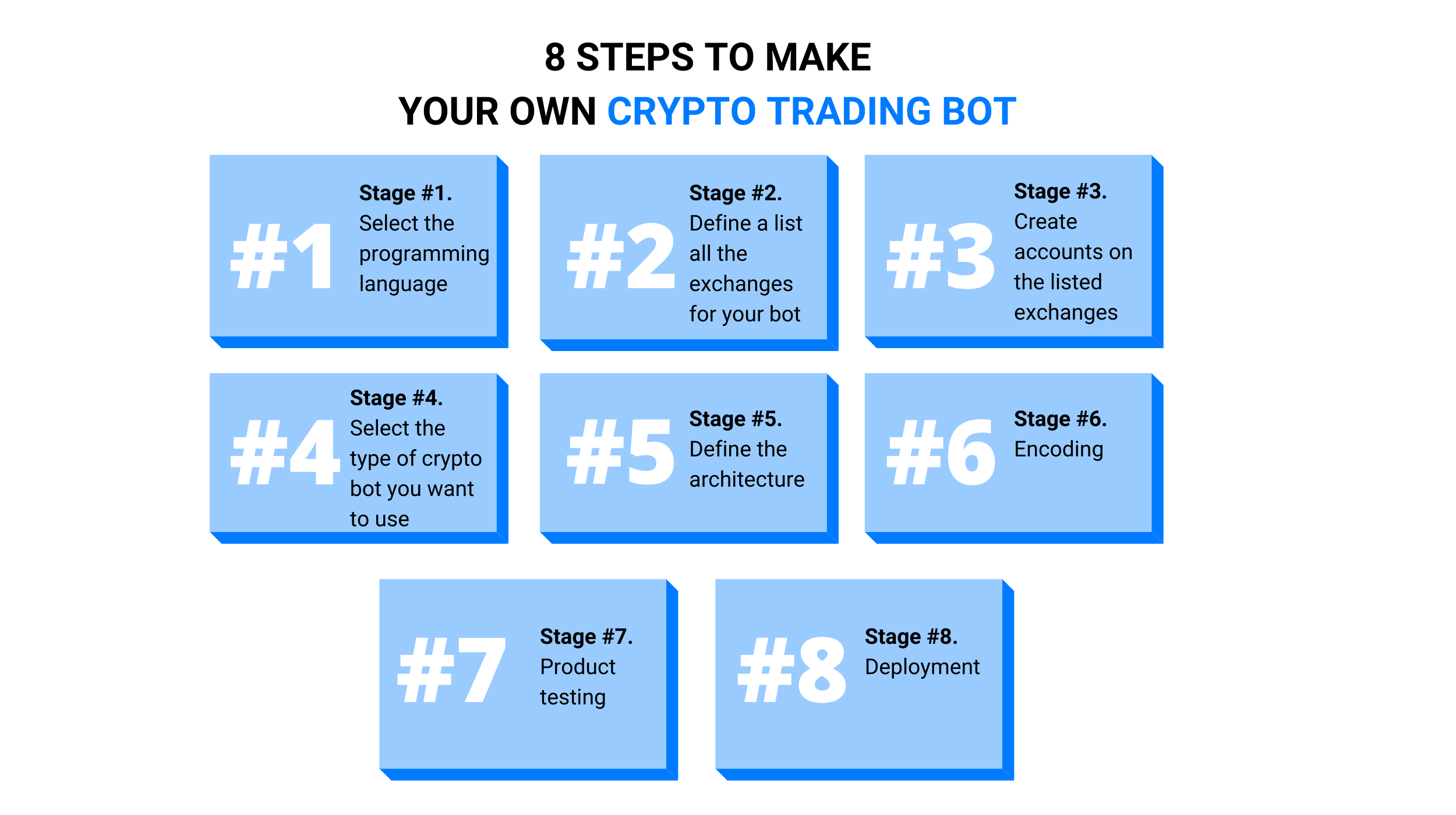

Now, when you are familiar with crypto bots and the way they work, let’s go to a cryptocurrency bot development workflow. Follow these steps to build a useful bot:

- Stage #1. Select the programming language

There are two programming languages, we advise you to choose from. Ideal options are Javascript and Python. They will make life easier for you and the programmers. - Stage #2. List all the exchanges

List all the feasible exchanges your bot should work with. It will give coders an idea of what services you will be using. - Stage #3. Create accounts on the listed exchanges

Create accounts on all cryptocurrency exchanges. Notice that some services allow trading anonymously, while others require approval. - Stage #4. Select the type of cryptocurrency bot you want to use

Before developing a crypto bot, select the type of trading strategy you will be using. Just notice that a complicated algorithm will take longer. - Stage #5. Define the architecture

Confirm the algorithm you are using for the bot has a robust base. On the contrary, you could lose money. - Stage #6. Encoding

Coding is the key part of the process. Discuss with the programmers your expectations. A skilled development team will help you with everything from algorithmic complications to user interface design. - Stage #7. Testing

When the coding is finished, it’s time to test the bot. Make sure your bot is working properly, not crashing, or detecting errors. Check if your trading bot can handle complex data. - Stage #8. Deployment

A good company provides support for a while, even after the app is released. It allows the business to move seamlessly.

How to Create Your Own Cryptocurrency App: Everything You Need to Know

Technologies Required to Develop Your Own Crypto Bot

The choice of programming language depends solely on the capabilities and features that a trading bot should have. Thus, it’s better to use a programming language that is widely supported and has an active cryptocurrency community. Besides, you need to confirm that it can be easily scaled, adapted and added as the need arises. This is handy when you want to connect with the community to support development. In 2021, the most widespread programming languages for writing trading bots are JavaScript and Python.

JavaScript comes first with approximately 11.7 million active developers, followed by Python with approximately 8.2 million active developers. Both programming languages have broad support in the developer community and are largely compatible with the cryptocurrency environment. Python is primarily used by developers who need the ability to express concepts in fewer lines of code. What’s more, high-performance Python libraries make it easy to research and prototype. Other coders choose JavaScript as it’s dynamic, prototype-based and multi-paradigm.

Besides to already mentioned programming languages, you may need to use some other technologies. Here is the list of the main of them:

✔ UI — ReactJS + Material UI

✔ Strategy implementation — NodeJS

✔ Transaction data logging — RDS + Redis

✔ Scheduler — Cron

✔ Support of different currencies (ETH) — web3.js

✔ Reliable security measures — Encrypting Data With SSH Keys

✔ Market tracking — RESTful API /Socket.IO

✔ Notifications — SES or push notifications (Firebase)

Final Thoughts

Summing up, cryptocurrency trading is gaining momentum again and is attracting many brave investors. If you just want to try your luck and treat this activity like gambling or a passing fad, you can play with open-source trading bots. If you are looking to try and test your investing skills, there are several solutions with reasonable subscription plans. However, if you want to make cryptocurrency trading a staple of your income, consider creating your own trading bot for the best security and performance.

Your own trading program or platform developed by professionals gives you complete control, including strategy selection, customization, fraud protection, etc. In addition, you can earn income both from using the bot and from selling it to other enthusiasts. There are many monetization models available to make your software both beneficial to you and attractive to your users.

📌 Read also:

▪ NFT Wallet Development: The Ultimate 2022 Guide

▪ How to Create a Decentralized Cryptocurrency Exchange: 6-Steps Guide

▪ How to Hire a Blockchain Developer: Required Skills & Pitfalls

▪ How to Create a Cryptocurrency Wallet App: an In-depth Guide for 2022

Popular

Latest