Since the invention of the Decentralized Finance model, the financial industry has changed a great deal. Offering better, cheaper, and faster services than traditional banks, DeFi apps are being embraced by more users around the world.

In a July 2022 report from Statista, the figures show a whopping 300,000 more persons used DeFi apps in the preceding six months. Deeper penetration of smartphones, internet facilities, and more access to financial services available on DeFi apps will make DeFi apps more popular and perhaps displace traditional financial models.

In this article, Code&Care will look at the meaning of DeFi apps, their types, how they work, and the steps to build a DeFi app. However, if you’d rather skip this and immediately begin hiring a blockchain development team, we’ve got you covered. Get in touch with us if you need assistance starting your blockchain-based business.

Table of Contents

- 1 What are DeFi Apps?

- 2 What are the Benefits of Venturing into the Blockchain Industry?

- 3 How Many Types of DeFi Apps Are There?

- 4 What Are the Important Components of DeFi Apps?

- 5 What are the Best Tech Stacks For DeFi Apps?

- 6 How Do You Build a DeFi App?

- 7 What are the Challenges in Building a DeFi App?

- 8 How Much Does It Cost to Develop a DeFi App?

- 9 Conclusion

- 10 Read also

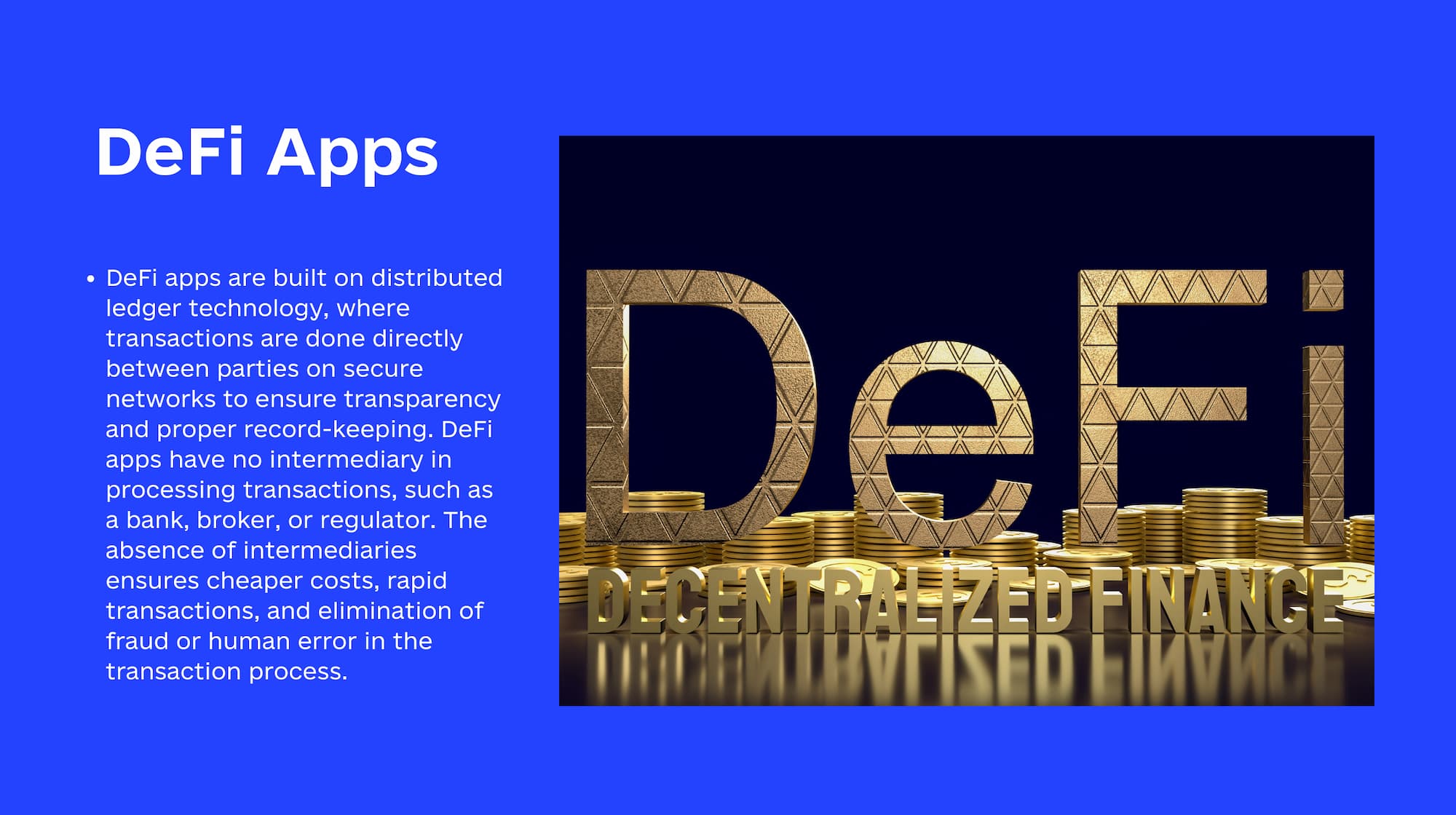

What are DeFi Apps?

Decentralized finance apps (DeFi apps) are financial applications that give users to wide-ranging banking services that run on cryptocurrencies. Users can enjoy lending, saving, borrowing, and investing using digital tokens.

DeFi apps are built on distributed ledger technology, where transactions are done directly between parties on secure networks to ensure transparency and proper record-keeping. DeFi apps have no intermediary in processing transactions, such as a bank, broker, or regulator. The absence of intermediaries ensures cheaper costs, rapid transactions, and elimination of fraud or human error in the transaction process.

What are the Benefits of Venturing into the Blockchain Industry?

Mainstream adoption of DeFi apps has the potential to open up the majority of the world’s population to the financial system as it is available to anyone with internet access globally.

Advantages to users

- DeFi usage is universal. They are open and accessible to everyone.

- The concept around cryptocurrencies is based on anonymity hence the user’s identity is kept confidential.

- Web 3.0 essentially builds on the idea of consensus rather than on centralization as the banking system is. Transactions on the blockchain are transparent and viewable on the decentralized ledger.

- Another great benefit of decentralization on the blockchain is that users are always in control of their funds.

- DeFi apps are interoperable, allowing new products to be built on them. So, users have a variety of options when it comes to investing or trading.

Advantages to business

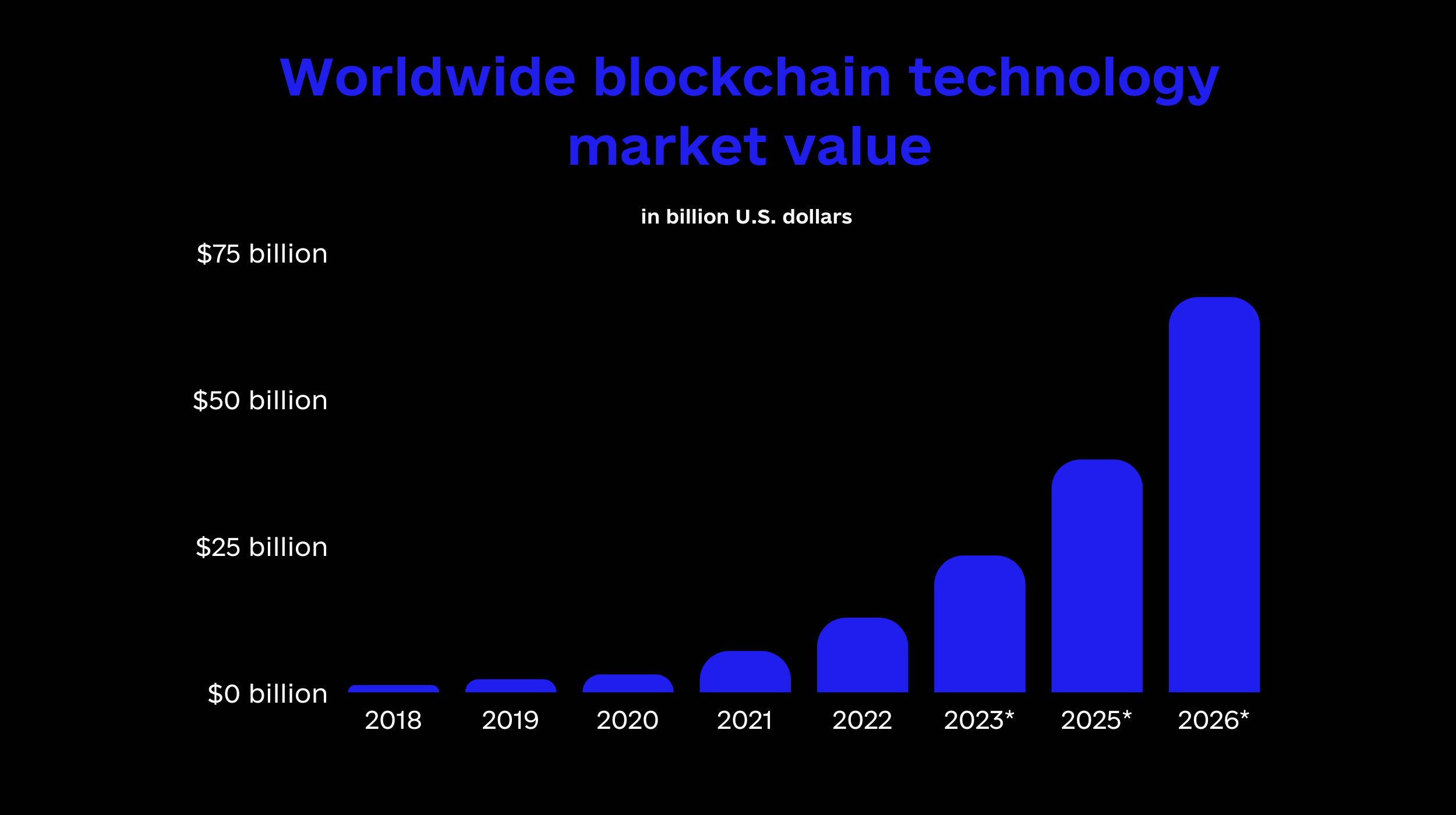

- Increased revenue. The blockchain industry is expanding rapidly. The blockchain market is expected to reach $3 billion by 2020, nearly tripling from its 2018 high of $1.2 billion in March 2022. So the skies are big enough for up and coming blockchain entrepreneurs and startuppers to fly.

- New markets. By building a DeFi app, you extend your presence globally, entering into emerging markets. This move both adds to the expertise and revenues of your company.

- Improved trust in your business. Since DeFi offers great varieties to customers, that in turn increases their experience and ultimately their trust in your business.

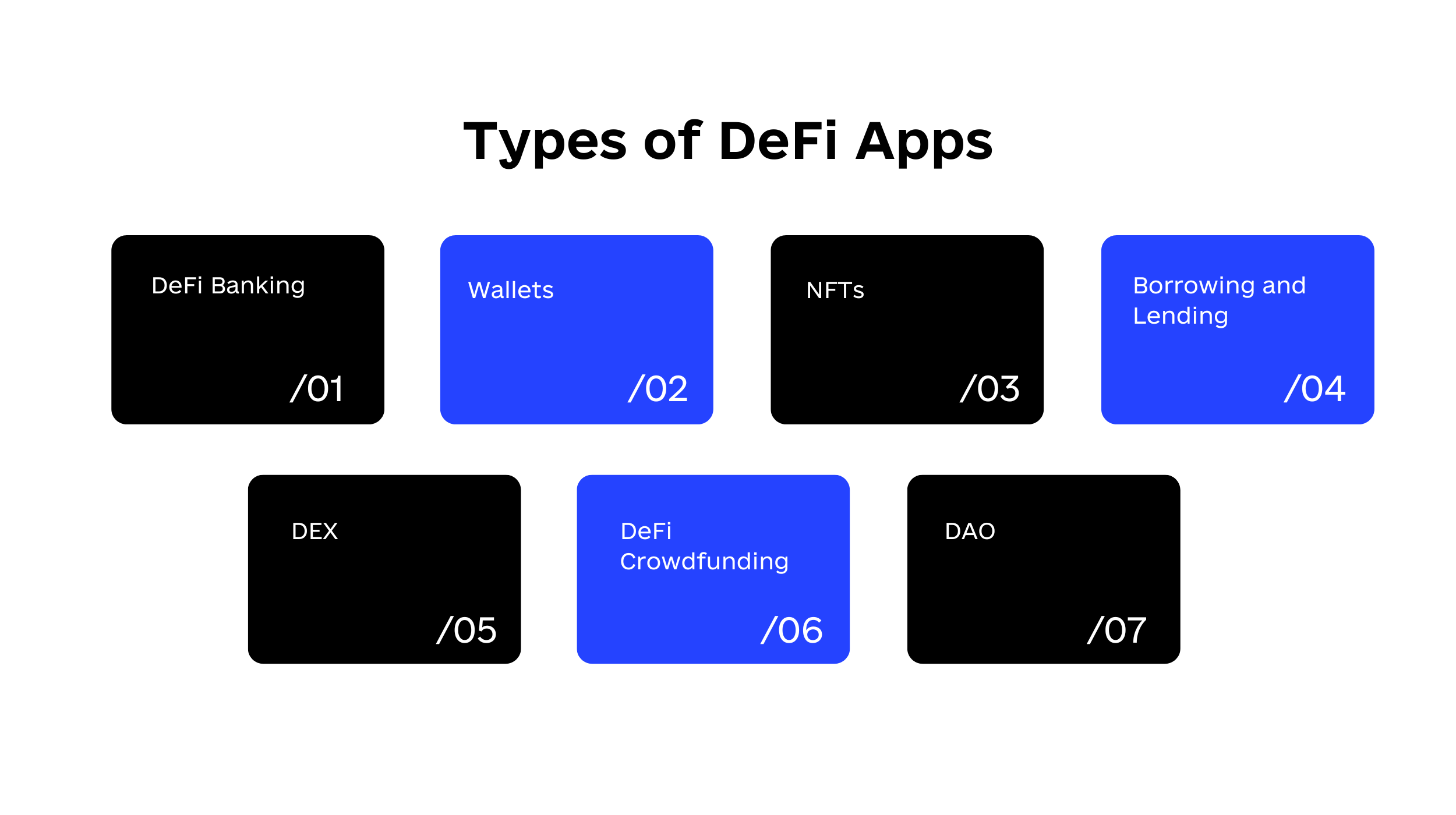

How Many Types of DeFi Apps Are There?

According to DeFiprime, there are about 205 DeFi projects and 180 of them are built on Ethereum. In other words, DeFi apps exist in different forms, and you may focus on one of these or combine them to build a product to meet your project objectives. Let’s delve deeper into these DeFi apps.

DeFi Banking

Perhaps the most common form of DeFi apps, they help you perform banking tasks such as payments, savings, and lending directly with another user using cryptocurrency. The absence of an intermediary ensures lower costs and fairness in transactions.

Wallets

A wallet can be likened to a bank account only where you deposit and withdraw cryptocurrencies instead of fiat currency. DeFi wallets help you store digital coins on various blockchains. MetaMask, Coinbase wallet, and Trezor are some popular DeFi wallets.

NFTs

Non-Fungible Tokens (NFTs) refers to digital forms of artwork, pieces of creativity, or other cryptographic tokens which cannot be divided or pirated. NFTs have a unique mark on them used to prove authenticity and validate the ownership of the item to its owner. Due to their uniqueness, NFTs are now used to collateralize loans and trade on online exchanges. Dharma Protocol is one such DeFi app.

Borrowing and Lending

DeFi Apps are also for borrowing and lending cryptocurrencies, generating lenders’ interest and allowing borrowers to access capital. Examples of borrowing and lending DeFi apps are Compound and MakerDao, where you lend money to the protocol and earn interest on the loan. To access loans, a borrower must put up collateral, usually a digital token, before getting the loan.

DEX

Exchanges are platforms for people to change currencies. Similarly, decentralized exchanges (DEX) enable the seamless swapping of cryptocurrencies directly and an online shop for users to purchase cryptocurrencies for their crypto wallet.

DeFi Crowdfunding

A great way to raise money for a cause or capital for a project is crowdfunding. No surprise there are crowdfunding DeFi apps that have also come to the fore and helped startups raise needed funds to execute their objectives.

DAO

Decentralized Autonomous Organisations (DAO) forums are community-led enterprises where every member contributes to the governance of the enterprise. In DAOs, there is no central body or person that makes decisions. Rather each member has an equal vote by employing smart contract contracts and blockchain technology. Flamingo DAO is a prominent DAO to acquire rare NFTs.

What Are the Important Components of DeFi Apps?

In this section, we will examine the important parts of a DeFi app. These components include stablecoins, smart contracts, wallets, and tokens.

Stablecoins

These coins were created to tackle the issue of volatility in cryptocurrencies. Stablecoins are pegged to another currency, mostly a fiat currency to maintain a consistent value. Tether USD, one of the most common stablecoins, is pegged to the US Dollar to maintain price stability. The role of stablecoins in DeFi apps helps investors make profits or yields on interest unaffected by volatility. Borrowing, lending, and derivatives trading work well with stablecoins.

Smart contracts

are the mechanisms used in the blockchain ecosystem to bind parties to their agreement. It is an automatic and self-executing covenant that removes the need for intermediaries and paperwork. Smart contract functions by parties agreeing to some terms and conditions upon which the contract is executed.

DeFi Wallets

A DeFi wallet helps you store your cryptocurrency and gives you access to the digital financial system. A DeFi wallet contains private keys unique to a user while keeping the user’s identity confidential. Without a DeFi wallet, you cannot take advantage of DeFi apps.

Tokens

As a blockchain-based financial tool, DeFi apps need cryptocurrencies to function. Either as investment tokens or governance tokens. Depending on the type of DeFi app you want, you may create a unique cryptocurrency to use on the platform.

What are the Best Tech Stacks For DeFi Apps?

Before settling for a tech stack to build your app, you should have some insight into the available tech stack for DeFi development.

Here are some factors to look out for before choosing one.

- DeFine your DeFi app

- The cryptocurrency to use

- Decide on whether it would run on a single blockchain or operate across blockchains.

A few stacks work great with the creation of DeFi apps. They include Ganache, Truffle, Solidity, and Remix. Let’s discuss them more.

Ganache

Ganache is a type of Ethereum blockchain environment used by developers to create blockchains similar to the Ethereum blockchain. Ganache incorporates Ethereum’s signature smart contract, which you can apply to your blockchain. Using Ganache, you can test, design, and distribute DeFi apps securely.

Truffle

Truffle is an integrated development environment used mostly in Web3 development. Truffle is a tech stack of tools, frameworks, and libraries used by developers to write smart contracts for blockchains. Code-linking, binary management, and contract deployment are some features of Truffle.

Solidity

Solidity is well known to Web3 developers as an object-oriented language with roots in C++. It is the language used to build smart contracts operating on the Ethereum blockchain.

Remix

Remix is used for testing, debugging, and deploying, among other functions. It is a tech stack written in Javascript. Using Remix gives your code the ability to run error easy-to-navigate bugs.

Technical Tips and Development Specs

We have seen the tech stacks you can use to build your DeFi app. Take note of the following tips.

- Ensure you select an SDK that works seamlessly with your DeFi app and does not require installing new plugins or extensions for users. In essence, it must have cross-platform abilities.

- Link to the Ethereum blockchain through Metamask or Toshi browser extensions instead of connecting directly to Ethereum.

- Always factor in the scalability of your DeFi app. Scalability helps the product cope with a large volume of users. DeFi apps give access to people with internet access across the world a chance in the financial sector. Thus scalability is initial. Solutions like GrapheneDB or MongoDB are great for scalability.

- Ensure you have an easy-to-navigate interface for users. The DeFi app puts off most users with its complex and confusing tabs. A simpler approach to UI/UX and explanatory text for tabs help.

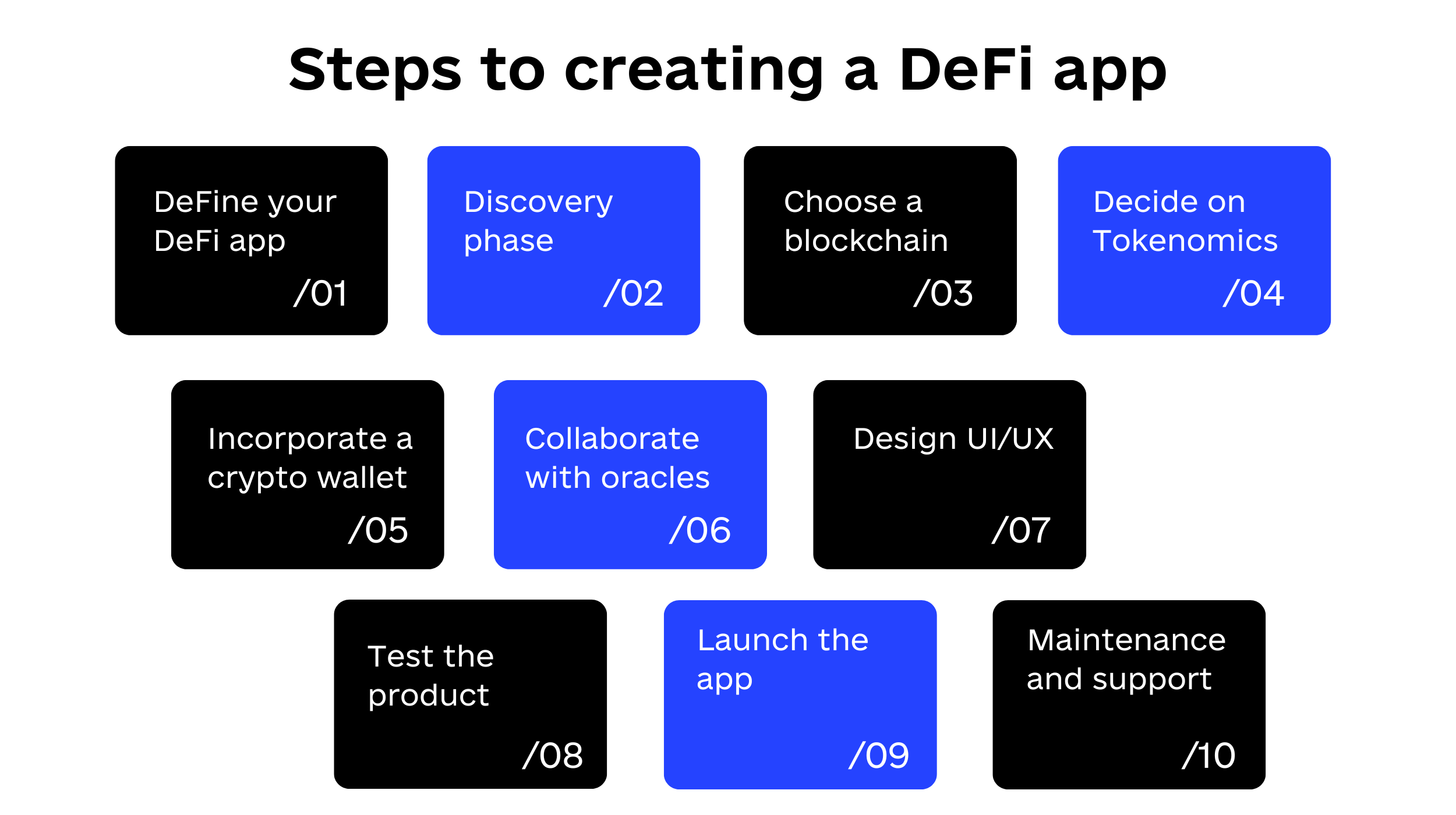

How Do You Build a DeFi App?

Let’s take a look at the steps to creating a DeFi app.

Step #1. DeFine your DeFi app

The commencement stage of your app development is to understand the type of DeFi app you are looking to develop. As stated earlier, there are different types of DeFi apps. Factor in the advantages and disadvantages of each one and decide on the one that works well with your goals.

Step #2. Discovery phase

In this next step, you must conduct market research to truly understand the DeFi apps and their reach in the market. During the discovery stage, you get to know the strengths and weaknesses of your competitors and improvements to existing DeFi apps.

Step #3. Choose a blockchain

There are several blockchains built to support Dapps, but which one is best? Ethereum is perhaps the most popular one due to its integrated smart contract abilities and its open-source nature, allowing other Dapps to be built on the blockchain. Apart from Ethereum, Cardano and TRON are other reputable blockchains to explore in building your DeFi app.

Step #4. Decide on Tokenomics

Tokenomics refers to the economics of cryptocurrencies taking into consideration their values, uses, supply, demand, distribution, etc. So you should know the type of cryptocurrencies to use. For instance, if you decide to build a DeFi app on the Ethereum blockchain, you can use digital coins like Ethereum (Eth), Polygon (MATIC), and Uniswap (UNI), among other ERC 20 coins. If you want, you can develop your cryptocurrency to work with your DeFi app.

Step #5. Incorporate a crypto wallet

Since cryptocurrency is the fuel on your DeFi app, there is a need to build a crypto wallet in the app’s interface. Crypto wallets allow users access to their coins. If your DeFi app is a banking DeFi, your crypto wallet has to be secure and tamper-proof. Although most crypto holders are wary of using a DeFi app’s crypto wallet due to trust issues. One way to encourage them to use yours is to add extra functionalities to your wallet.

Step #6. Collaborate with oracles

To make it functional, you need to feed the app with real data from third parties (oracles). For example, if your DeFi app is an investment DeFi app, you need stockbrokers’ data on stocks and securities. Note that the data from oracles may be hacked from a centralized system. To prevent your DeFi banking app from falling victim to hack attacks, you can use a solution like Chainlink, which works like blockchains and requires consensus before producing a result.

Step #7. Design UI/UX

The user interface is the first contact of users with the app. UI/UX determines the layout, images, fonts, logos and videos on the app. Working with the UI/UX designer the navigation tabs and information icons must be simple and explanatory enough for a first time user.

Step #8. Test the product

After the DeFi app is developed; you need a Quality assessment of the product to check for bugs and errors. You must also check if the DeFi app works well with other platforms (mobile and desktop versions).

Step #9. Launch the app

This stage is when the app is released commercially on app stores available on all platforms. Extensive marketing through ad placements and bonus offerings is needed to attract users to the app.

Step #10. Maintenance and support

When the product is launched, you have to keep the product up to date and operating optimally through upgrades and fixing bugs and glitches.

What are the Challenges in Building a DeFi App?

Decentralized app development is a relatively new concept and, like all fledgling innovations, is afflicted with some challenges. We will see some of the challenges.

Deciding on the right tech stack

Choosing the right tech stack is a problem you will likely encounter in this niche field. The stack choice will determine how well your DeFi app will work.

Testing challenge

DeFi apps consist of settlement, asset, protocol, application and aggregation layers. Testing the DeFi app with all the layers is a tedious process.

Data protection concerns

Security challenges with data sources and APIs: as explained earlier, you need secure data from third parties to enable your DeFi app to work optimally. However, this might open your app to the threat of hacking.

Performance issues

DeFi apps are built to handle high volumes of data and financial transactions, which must be concluded quickly. The cost involved in installing the needed infrastructure to handle these loads poses a challenge to investors.

Technologies

The programming languages needed for building DeFi apps are complex and not exactly developer friendly. Getting developers grounded in the technical aspects of DeFi development becomes critical.

Hiring the right development team

Assembling a software development team with experience in blockchains, cryptocurrencies, and app development can help you tackle these challenges. You can also offshore the development team to save costs.

How Much Does It Cost to Develop a DeFi App?

The financial implications for developing a DeFi app depend on several factors, including the app’s complexity. For instance, if you want to build a DeFi banking app incorporating lending, borrowing, investing, and saving services, you will likely rack up a high bill. The design, functionality, and wage demand all impact the costs.

Hiring a blockchain development team outside the United States and Western Europe can limit your costs. As a rough estimate, building a standard DeFi app will cost you over $100,000 (One Hundred Thousand Dollars). For a breakdown of the figures, contact Code & Care. Let us help you build an industry-leading DeFi app.

Conclusion

There you have it. DeFi apps have come to stay and will soon displace traditional banks. The convenience and inclusion it affords users make it a viable alternative to the traditional finance model. However, building a DeFi App requires the right know-how, which is what Code & Care provides with a portfolio of projects, including creating crypto exchanges and blockchain development.

Read also

Global software development outsourcing trends in 2023 (& What to look for next)

How to Build a Product Roadmap for a Start-up

What Is The Difference Between A Programming Language And A Framework?

Your Go-to Guide to Live Streaming Shopping App Development in 2022

Popular

Latest