The main distinction between neobanks and traditional banks is that neobanks are totally digital. They don’t have any physical offices and only interact with customers through phone, email, and chat. All products in neobanks are collected in a convenient mobile application that helps users to access their money 24/7. These apps are innovative and design-oriented, and the interface makes them very user-friendly.

In the table below, we’ve listed the key differences.

| Difference |

Traditional bank |

Neobank |

| ✅ Service platform |

A physical establishment |

Online |

| ✅ User relation |

Long-term client relations – often in-person |

The relationship is short, virtual, and can easily change over time |

| ✅ Fee structure |

Commissions are higher than those of neobanks |

The charges are low |

| ✅ Licensing |

Full banking licenses |

Most banks have no or partial license |

| ✅ Accessibility |

Traditional banks still rely on paperwork. So, they often run slower |

Neobanks offer faster adaptation as their processes are fully digitalized |

Market Overview

- Every year more and more fintech companies start offering banking services to their clients. The total number of bidding banks and digital-only banks is growing. As of 2020, more than 300 neobanks were launched in the world. According to Zion Market Research forecasts, the non-banking sector will grow at a CAGR (compound annual growth rate) of 5% between 2019 and 2026, generating about $394 billion by 2026.

- Customer dissatisfaction with traditional banks plays directly into the hands of neobanks and aspiring banks. People are fed up with hidden fees, ridiculous pricing, and not-so-user-friendly solutions for processing financial data. If retail banks don’t address these issues, they could lose up to $16 billion in revenue, $344 billion in retail deposits, and 11% of their customers to competitors, including digital-only players.

- The growth in the number of neobanks will be largely supported by the growing demand for digital banking from young consumers, as well as the growing confidence of consumers of all ages in digital banking.

- The United States has one of the highest numbers of digital-only bank account holders at 23.1 million. It stands ready to sustain this growth thanks to the country’s huge population and the ability to take pride in some of the world’s oldest digital-only banks.

Main Players on the Market

Let’s move on to an overview of the leading digital banks and what they currently offer to their customers.

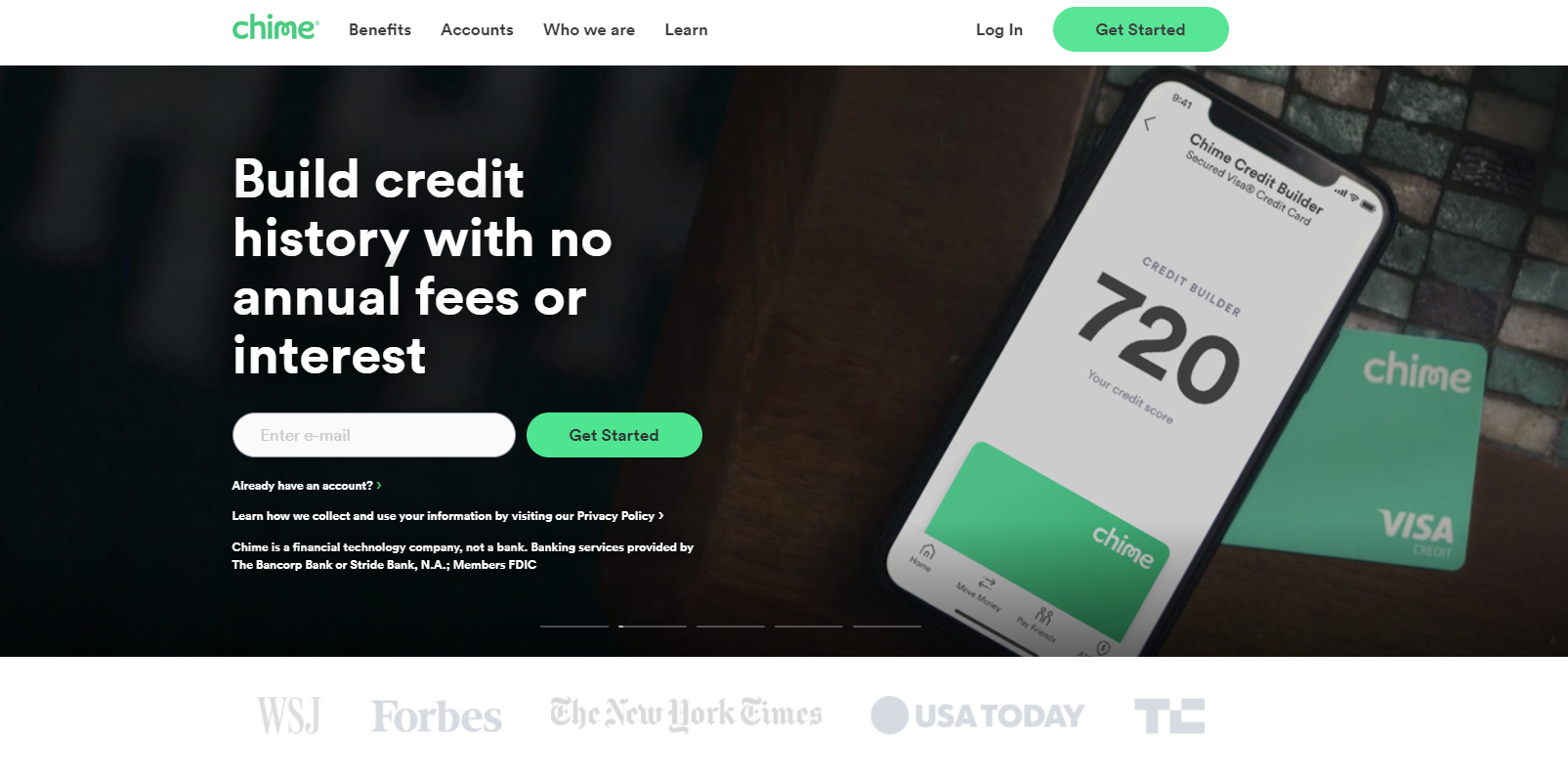

☑ Chime

The company provides its customers with free financial services with no monthly fees or transaction fees and earns from commission fees paid by sellers from whom Chime users make purchases. The main advantages of using Chime: getting paid 2 days in advance, withdrawing money without commission from more than 60,000 partner ATMs, and overdraft up to $ 200 with a debit card.

☑ mBank

Although most neobanks started in the 2000s, mBank was a pioneer. Founded in 1986, the company was the first of its kind in Poland and remains the most popular digital bank in the country. In addition, it has now also expanded its presence to enter the list of the most popular in the Czech Republic and Slovakia.

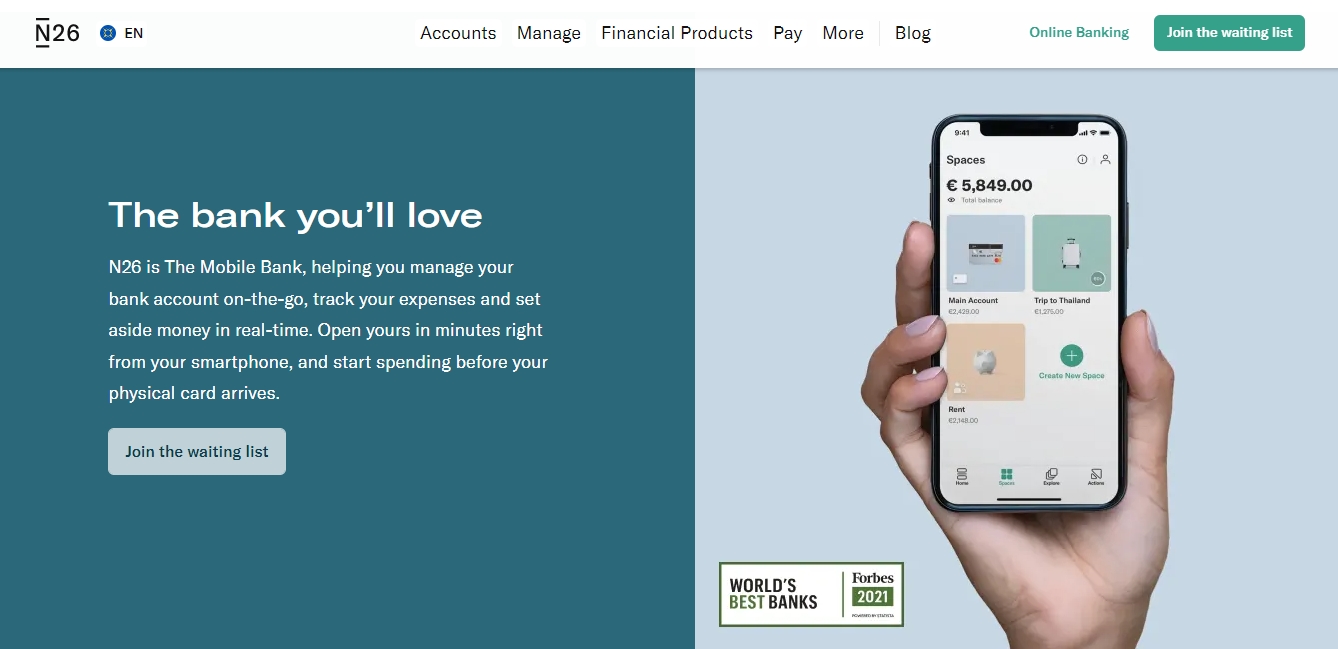

☑ N26

You can register for an N26 account in just a few minutes and you will receive a linked card for payments and ATM withdrawals. N26 accounts also offer tools to help you save money, get refunds on card purchases, and smart tools to help you analyze your spending and get the best budget. N26 cards are compatible with Google Pay and Apple Pay for easy mobile payments.

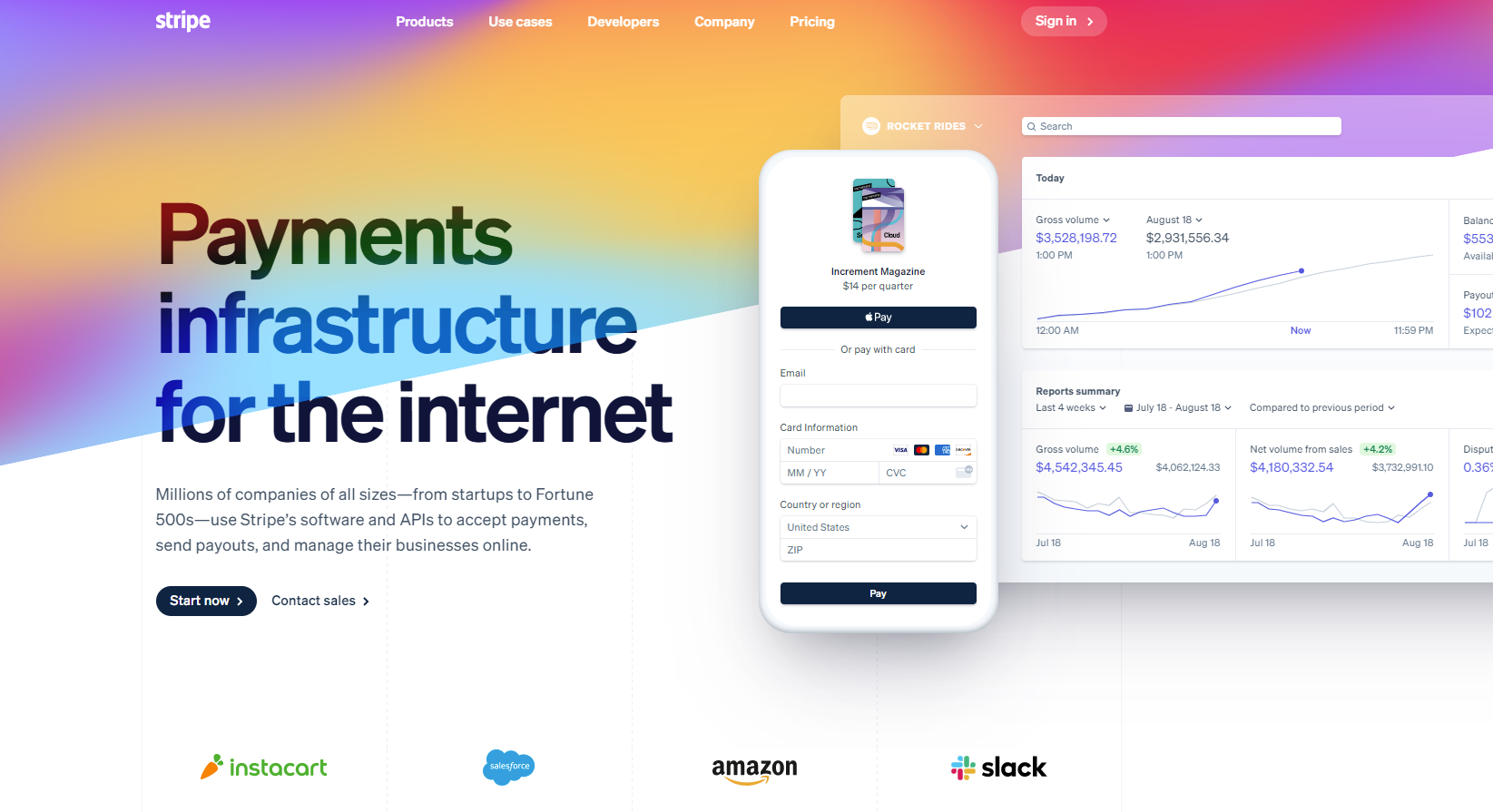

☑ Stripe

Stripe is ranked first in both Switzerland and the Netherlands in Business Financing rankings. Stripe doesn’t look or act like a traditional financial institution or even like a neo-bank. The software-as-a-service company is instead developing open APIs for account management and other online business functions for small and large businesses. What Stripe gives you a bank angle is not a checking or savings account. Instead, corporate cards and lending give the company a place on the list. Stripe had just over 900,000 requests per month worldwide.

☑ Revolut

Business Financing found it to be the most popular digital bank in 17 countries. Revolut serves not only consumers but also specializes in services for small and medium businesses. Globally, Revolut had a monthly number of 989,200 requests.

The Key Features of Neobanks

Neo banking offers several features and benefits. Some of the key aspects are:

⚙ Online banking

You can use banking services from anywhere at any time convenient for you. Thanks to high-quality and advanced technological solutions, you can quickly and easily get banking services.

⚙ Personal finance planning

The banking sector is highly competitive and each bank tries to offer unique solutions to gain an edge over its competitors. Several platforms offer various personal financial planning features such as loan and premium calculators, software, and tools for budgeting, forecasting, and tax planning.

⚙ Mobile banking

You can perform all financial transactions through your bank’s mobile application using your smartphone or tablet on the go. You can access your banking services and products 24 hours a day, seven days a week, making it easy to complete banking transactions at your convenience.

⚙ Digital wallet

Digital wallets are also known as virtual wallets and allow you to pay money through your smartphone. With these virtual wallets, you no longer need to carry cash with you when traveling or shopping.

⚙ Loyalty programs

Digital reward and loyalty programs allow you to promote products and attract customers. These digital programs offer cost-effective and measurable rewards for customer acquisition and retention.

⚙ Phone banking without internet

You can also conveniently perform banking transactions without an active Internet connection. Services such as telephone banking, SMS alerts, and missed calls allow you to access your bank’s products even if you don’t have an Internet connection.

⚙ Automated bill payment

You pay multiple bills each month, including electricity, gas, cell phone, credit card, and more. In addition, you can equate the monthly premiums (EMI) on your home, car, personal, or other loans and premiums that need to be paid.

⚙ Cashbacks and discounts

Most financial institutions offer refund offers and discounts on your purchases and expenses. Some banks may also offer coupons that you can use for rebates and discounts on certain purchases.

⚙ Protected message alerts

The advantage of digital bank accounts is that you receive real-time notifications of your transactions. While these notifications can sometimes seem annoying, they can help prevent fraud.

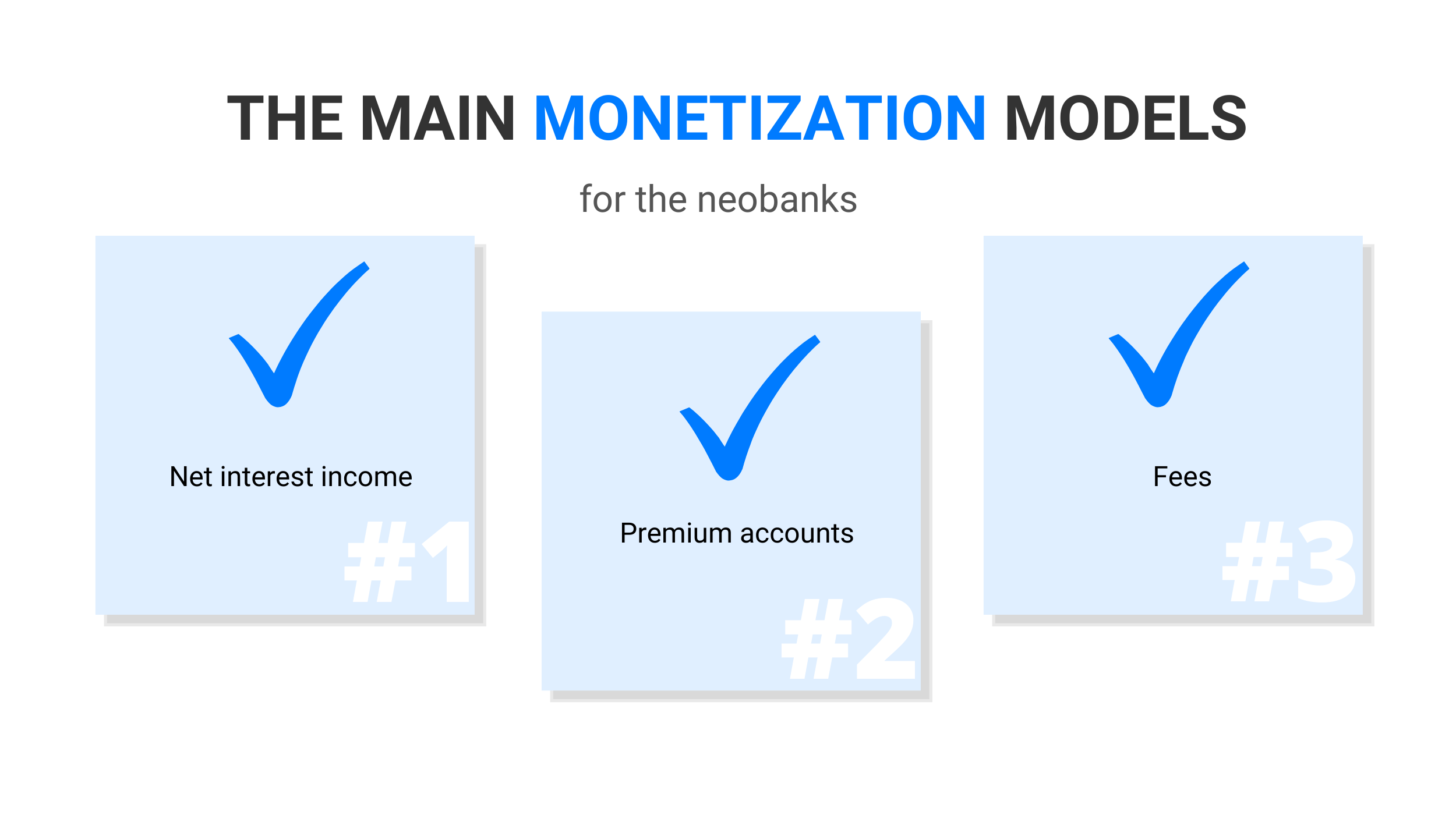

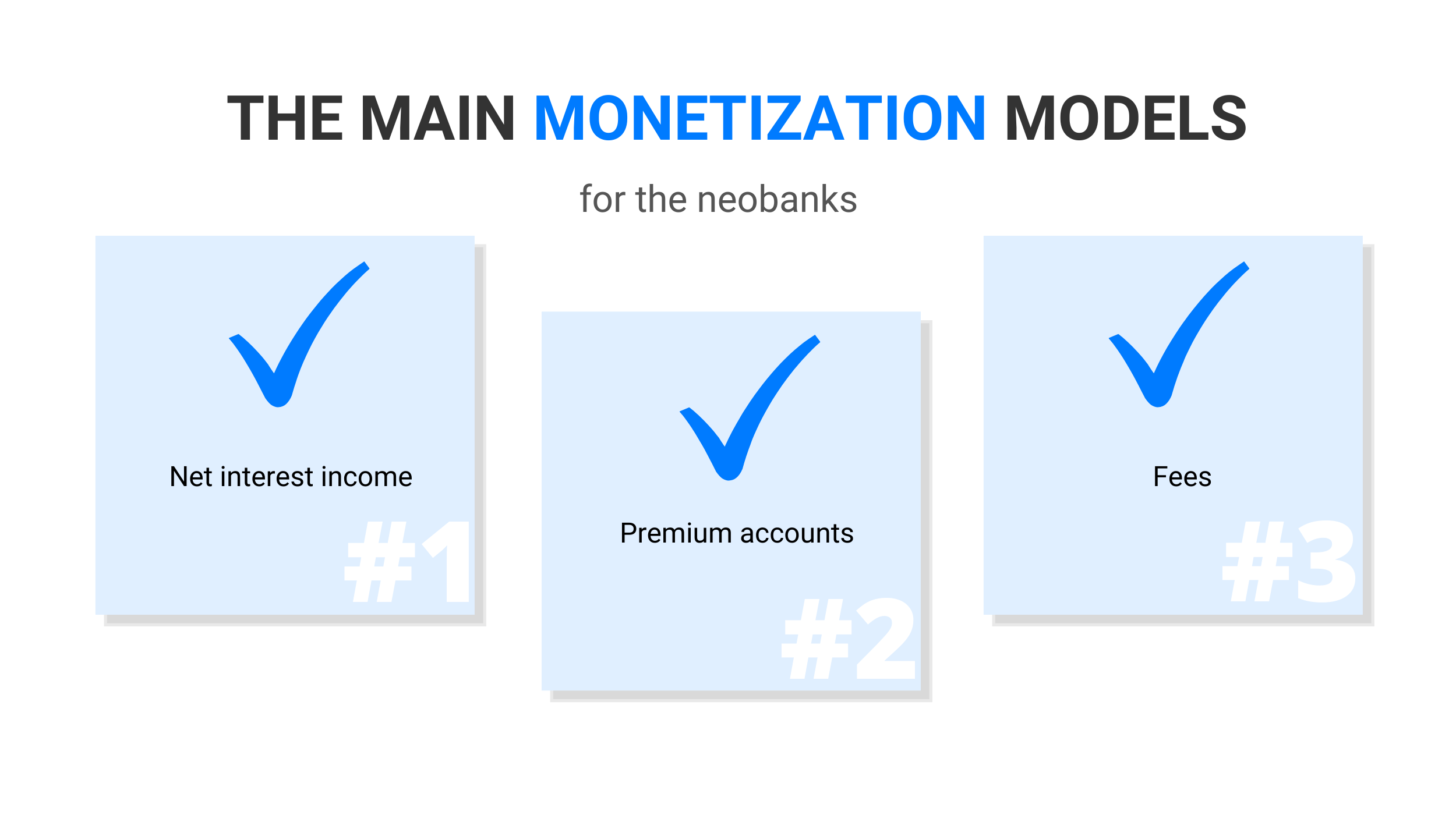

How do Neobanks Make Money?

Let’s overview the main monetization models for the neobanks.

1⃣ Net interest income

The much more scalable underwriting policy of neobanks in comparison with traditional banks is their benefits and drawbacks at the same time. On the one hand, due to a more scalable policy, neobanks get a user pool faster. But at the same time, it considerably increases the risk of the loan portfolio.

2⃣ Premium accounts

Offering a premium account with posh features like metal card, travel insurance, overseas health insurance, better savings rates, lounge passes, and more, it’s a great way to turn a paying subscriber into an app user with free downloads. By offering your clients a choice of two or three levels, your chances of getting more money from the client are increased.

3⃣ Fees

Commissions are the critical source of profit for neobanks. Even with the fact that most startups in the industry use zero fees as a marketing mechanism to attract people, this statement is not entirely true, as they receive a share of interbank fees.

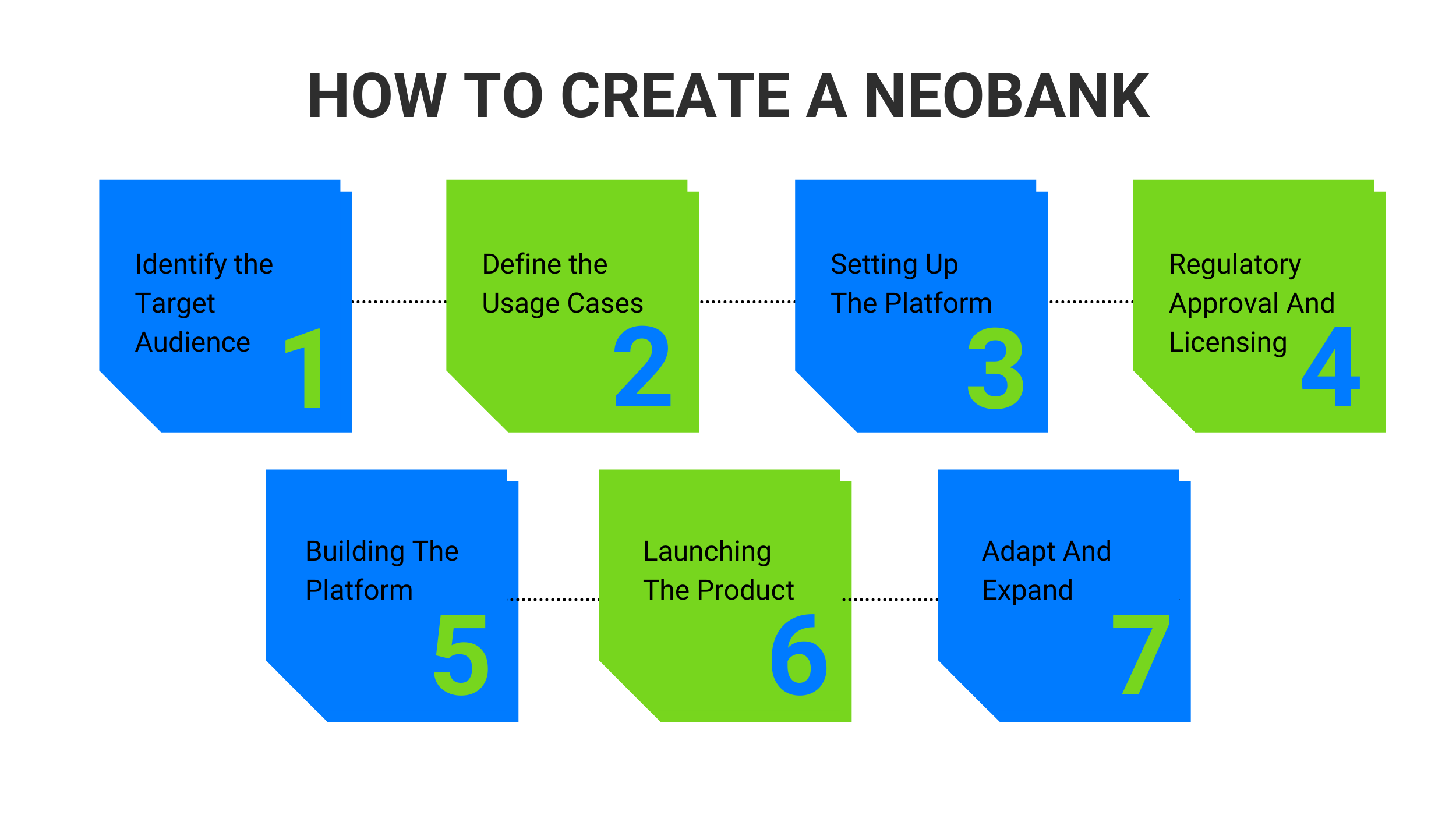

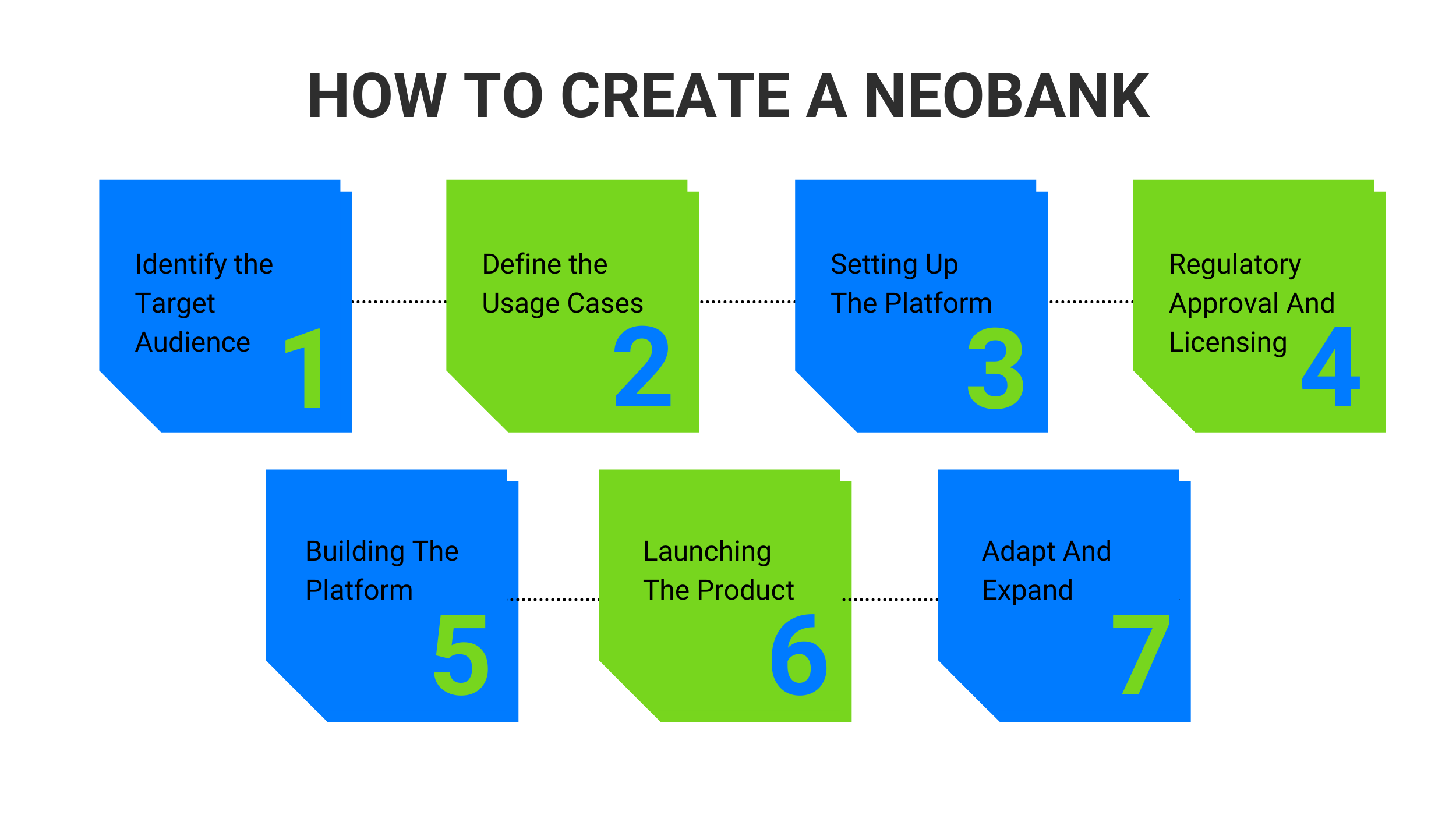

How to Build a Digital Bank from Scratch?

We’ve worked with several clients on their journey to digital transformation and have been in the industry since the early days of the digital revolution. From our perspective, here are 7 key steps in building a digital bank from scratch.

Stage #1. Identify the Target Audience

Understanding your customer is the first step to creating a digital bank. It is important to define a clear strategy. A clear strategy helps you determine what your value proposition will be and why.

Stage #2. Define the Usage Cases

Usage cases are the next step in the process of building your digital bank. Along with this, you should naturally also describe in detail the required business and technical requirements and of course describe the user interaction process.

Stage #3. Setting Up The Platform

There are three strategies you can use when it comes to setting up your platform:

- Create your platform,

- Buy an existing platform,

- Become a partner of an existing platform.

Typically you will use a combination of the three above. Why? Because building an effective platform requires you to pay attention to many disparate moving parts and make sure that each part interacts with the other.

Stage #4. Regulatory Approval And Licensing

Regulatory approval is an important part of a successful digital bank. With new and stricter rules being introduced in different countries, your digital bank will need to be aware of the changing landscape and different requirements in different countries.

Stage #5. Building The Platform

Building a platform can also be thought of as creating a banking experience or defining how your customer will interact and interact with the bank. Simplifying the process and eliminating traditional pain points are some of the key factors that have led to the rapid adoption of these non-bank banks among clients.

Stage #6. Launching

You have finally reached the last step. However, once the finish line is already in sight, it is important to stay focused and be aware of potential obstacles ahead. Consider also that customer lifetime value can range from zero to many thousands, depending on the type of customer and product, and it is clear that the journey from launch to success is not easy.

Stage #7. Adapt And Expand

Finally, get ready to adapt. The financial technology industry is dynamic, and technology can drive change at a fast pace. Thus, your flexible digital bank is better suited to this changing landscape than, say, traditional banks, but it is not immune to its consequences.

Popular

Latest